Cash Offer vs. Mortgage: Best Way to Buy a Home in Georgia in 2026 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

Exploring the advantages and disadvantages of cash offers and mortgages in the real estate market of Georgia, along with the financial implications, promises a compelling journey for readers seeking insights into home buying strategies.

Cash Offer vs. Mortgage: Best Way to Buy a Home in Georgia in 2026

When it comes to buying a home in Georgia in 2026, there are various factors to consider, including whether to make a cash offer or opt for a mortgage. Each option has its own set of advantages and disadvantages that can significantly impact your overall financial situation.

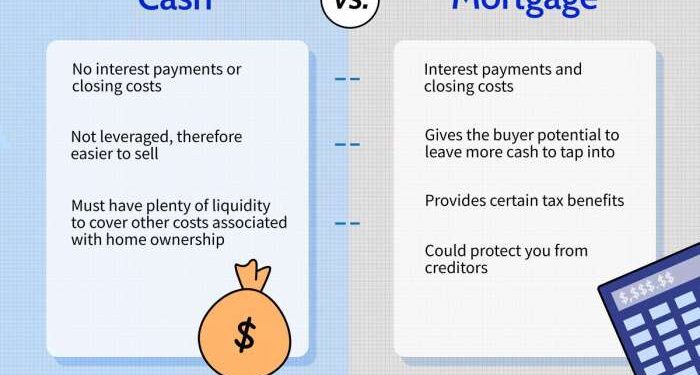

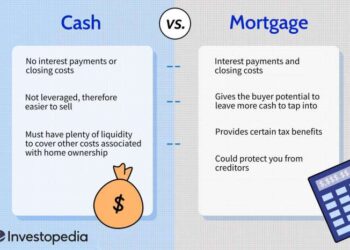

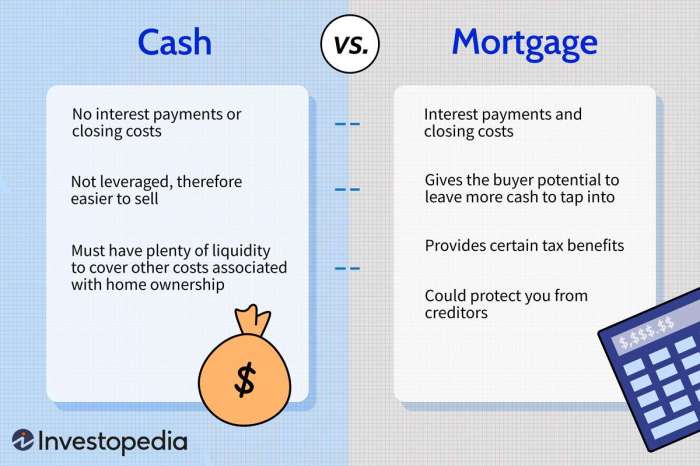

Advantages and Disadvantages of Making a Cash Offer

Making a cash offer when buying a home in Georgia can provide several benefits, such as a quicker closing process, as there is no need to wait for mortgage approval. Additionally, cash offers are often more attractive to sellers, potentially giving you an edge in a competitive market.

However, tying up a large amount of cash in a single asset may limit your liquidity and investment opportunities. It's crucial to consider the opportunity cost of not leveraging that cash elsewhere.

Benefits of Opting for a Mortgage

Choosing a mortgage instead of a cash offer in the real estate market of Georgia in 2026 can offer advantages like preserving liquidity, allowing you to keep cash on hand for emergencies or other investments. Moreover, mortgages can help you build credit through timely payments, potentially improving your financial standing in the long run.

However, it's essential to consider the interest rates and fees associated with a mortgage, as they can significantly impact the total cost of homeownership over time.

Financial Implications of Choosing a Cash Offer over a Mortgage

Opting for a cash offer when purchasing a home in Georgia can lead to immediate savings in terms of interest payments and closing costs. However, it's essential to assess the impact on your overall financial portfolio and long-term goals. By forgoing a mortgage, you may miss out on potential tax benefits and the opportunity to diversify your investments.

Consider consulting with a financial advisor to evaluate the best approach based on your individual financial situation.

Market Trends and Interest Rates

As of 2026, the real estate market in Georgia is experiencing steady growth, with an increasing demand for homes across the state. This trend is driven by factors such as population growth, job opportunities, and a desirable living environment.

Current Real Estate Market Trends in Georgia

The real estate market in Georgia is characterized by a seller's market, where demand outweighs supply, leading to higher home prices. This competitive market environment often favors cash offers, as they are more attractive to sellers due to their quick and guaranteed transactions.

Interest Rates for Mortgages in Georgia

The interest rates for mortgages in Georgia are influenced by various factors, including the national economy, inflation rates, and the Federal Reserve's monetary policy. As of 2026, mortgage interest rates in Georgia are relatively low compared to historical averages, making borrowing more affordable for potential homebuyers.

Impact of Interest Rate Fluctuations on Home Affordability

Fluctuations in interest rates can significantly impact the affordability of homes for buyers. A rise in interest rates can increase the cost of borrowing, making mortgages more expensive and potentially limiting the purchasing power of buyers. In such scenarios, cash offers may become more appealing as they eliminate the need for borrowing and the associated interest costs.

Legal and Financial Considerations

When it comes to buying a home in Georgia, there are important legal and financial considerations to keep in mind. Whether you are considering a cash offer or a mortgage, understanding the implications is crucial for a smooth home buying process.

Legal Requirements and Implications

In Georgia, making a cash offer may streamline the buying process as it eliminates the need for financing contingencies. However, it is essential to ensure that all legal requirements, such as property inspections and title searches, are still fulfilled to protect your investment.

On the other hand, opting for a mortgage involves a more structured process that includes lender requirements and legal documentation to secure the loan.

Financial Planning

For a cash offer, buyers need to consider the upfront costs, including the full purchase price of the home, taxes, and closing costs. While a mortgage allows for spreading out payments over time, it also involves interest payments and potential fees.

Understanding the long-term financial implications of each option is crucial for making an informed decision that aligns with your financial goals.

Role of Credit Scores and Financial Stability

Credit scores play a significant role in obtaining a mortgage in Georgia. Lenders use credit scores to assess the borrower's creditworthiness and determine the interest rate. A higher credit score can lead to more favorable loan terms, while a lower score may result in higher interest rates or potential loan denial.

Financial stability, including income stability and debt-to-income ratio, also plays a crucial role in determining whether a cash offer or mortgage is the best option for buying a home in Georgia.

Local Real Estate Policies and Incentives

When it comes to buying a home in Georgia, understanding the local real estate policies and incentives can play a significant role in deciding between a cash offer and a mortgage. These factors can influence the overall cost, feasibility, and benefits of each purchasing method.

Government Programs and Initiatives

Government programs and initiatives in Georgia can have a direct impact on the decision-making process between a cash offer and a mortgage. For instance, certain programs may offer incentives or tax breaks for cash buyers, while others may provide assistance or reduced interest rates for mortgage holders.

It is essential to stay informed about these programs to leverage any advantages they may offer.

Down Payment Assistance and First-Time Homebuyer Incentives

Down payment assistance programs and first-time homebuyer incentives in Georgia can be crucial factors in choosing the best way to buy a home in 2026. These programs can help reduce the initial financial burden of purchasing a home, making homeownership more accessible to a wider range of individuals.

By exploring these options, potential buyers can make a more informed decision based on their financial situation and goals.

Ultimate Conclusion

In conclusion, weighing the options between cash offers and mortgages for purchasing a home in Georgia in 2026 involves careful consideration of market trends, legal and financial factors, as well as local real estate policies. This thorough exploration equips prospective homebuyers with the knowledge needed to make informed decisions and navigate the complexities of the housing market with confidence.

Top FAQs

What are the tax implications of choosing a cash offer over a mortgage?

Choosing a cash offer may lead to fewer tax deductions compared to mortgage interest deductions, impacting the overall cost of homeownership.

How do interest rates in Georgia influence the choice between a cash offer and a mortgage?

Fluctuations in interest rates can significantly affect the affordability of homes, making it crucial to assess how they align with your financial goals.

Are there any specific government programs in Georgia that support cash offers or mortgages?

Some government initiatives, such as down payment assistance programs, may play a role in influencing the decision-making process for homebuyers.